(Click here for best resolution)

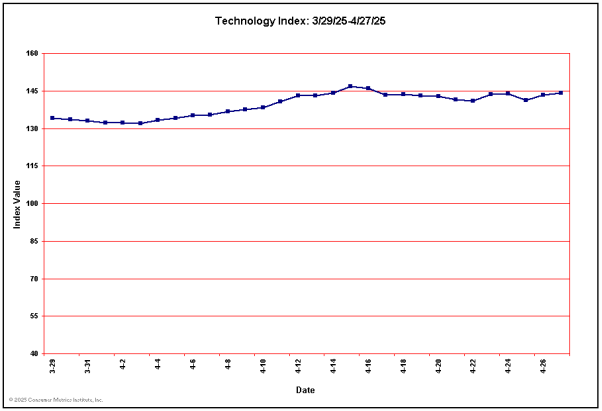

Last 10 Technology Index Values

| Date: | 05/28/2025 | 05/29/2025 | 05/30/2025 | 05/31/2025 | 06/01/2025 | 06/02/2025 | 06/03/2025 | 06/04/2025 | 06/05/2025 | 06/06/2025 |

| Value: | 136.96 | 137.40 | 135.21 | 134.77 | 135.01 | 135.06 | 135.96 | 135.56 | 135.46 | 136.30 |