(Click here for best resolution)

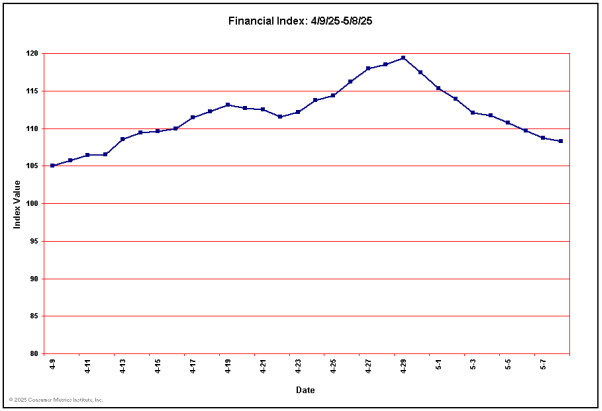

Last 10 Financial Index Values

| Date: | 05/28/2025 | 05/29/2025 | 05/30/2025 | 05/31/2025 | 06/01/2025 | 06/02/2025 | 06/03/2025 | 06/04/2025 | 06/05/2025 | 06/06/2025 |

| Value: | 102.84 | 103.68 | 104.96 | 105.76 | 106.50 | 107.08 | 107.25 | 108.38 | 109.30 | 109.31 |