(Click here for best resolution)

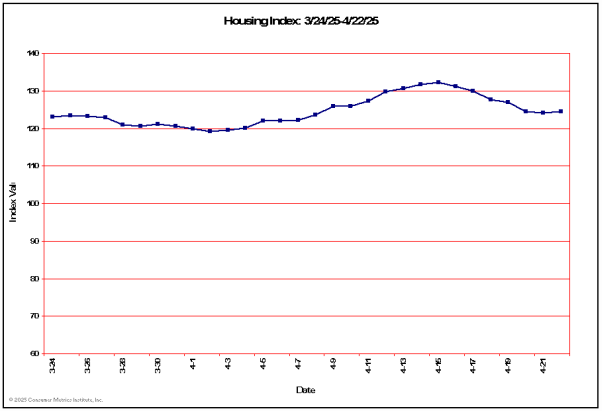

Last 10 Housing Index Values

| Date: | 05/28/2025 | 05/29/2025 | 05/30/2025 | 05/31/2025 | 06/01/2025 | 06/02/2025 | 06/03/2025 | 06/04/2025 | 06/05/2025 | 06/06/2025 |

| Value: | 117.72 | 118.75 | 119.51 | 119.53 | 120.24 | 121.29 | 120.97 | 121.60 | 121.22 | 121.38 |